Bridging the digital divide to empower farmers- solving farm facilitators biggest technical challenge in Sofol

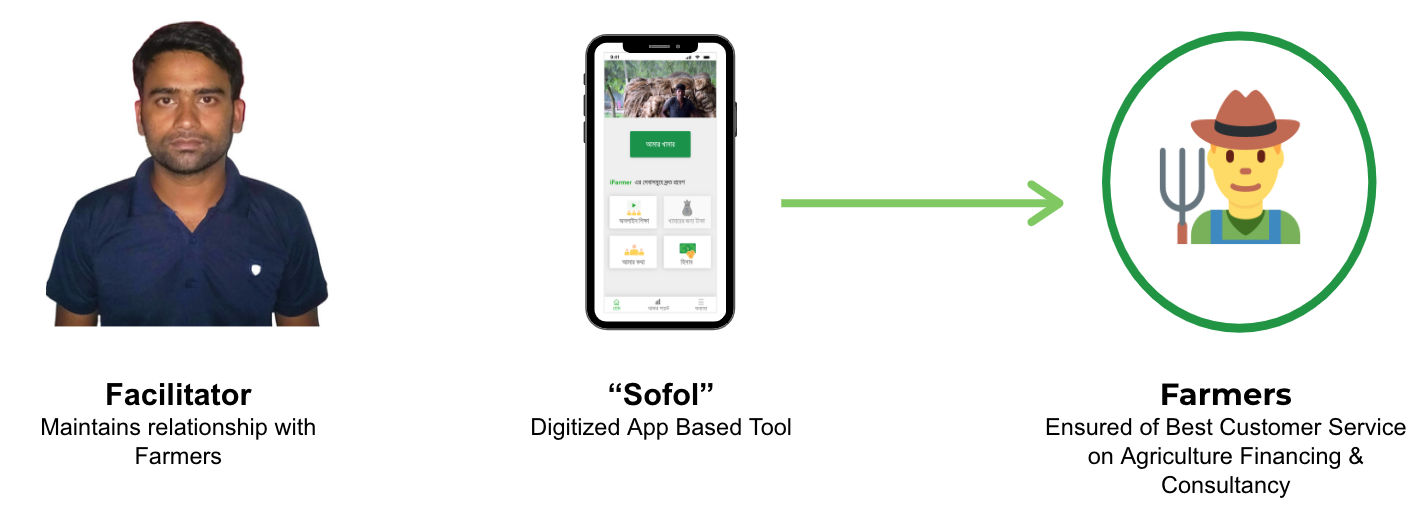

Agriculture is one of the most underprivileged and deprived sectors in Bangladesh. There are about 16.5 million farmers in Bangladesh and agriculture contributes around 13% of the GDP. But nearly 13 million farmers have to rely on informal sources of finance at high-interest rates. Farmers receive almost little to no profit from farming for lack of access to finance, market, quality inputs and services. To empower farmers, iFarmer utilizes human agents, mobile technology, and remote sensing to reduce the cost and complexity of working with smallholder farmers. We call our human agents, Facilitators, who maintain relationships with Farmers to ensure the best customer service on agriculture financing and consultancy. To offer a seamless service, our facilitators use Sofol, an app aimed to provide the best agriculture-related services to farmers.

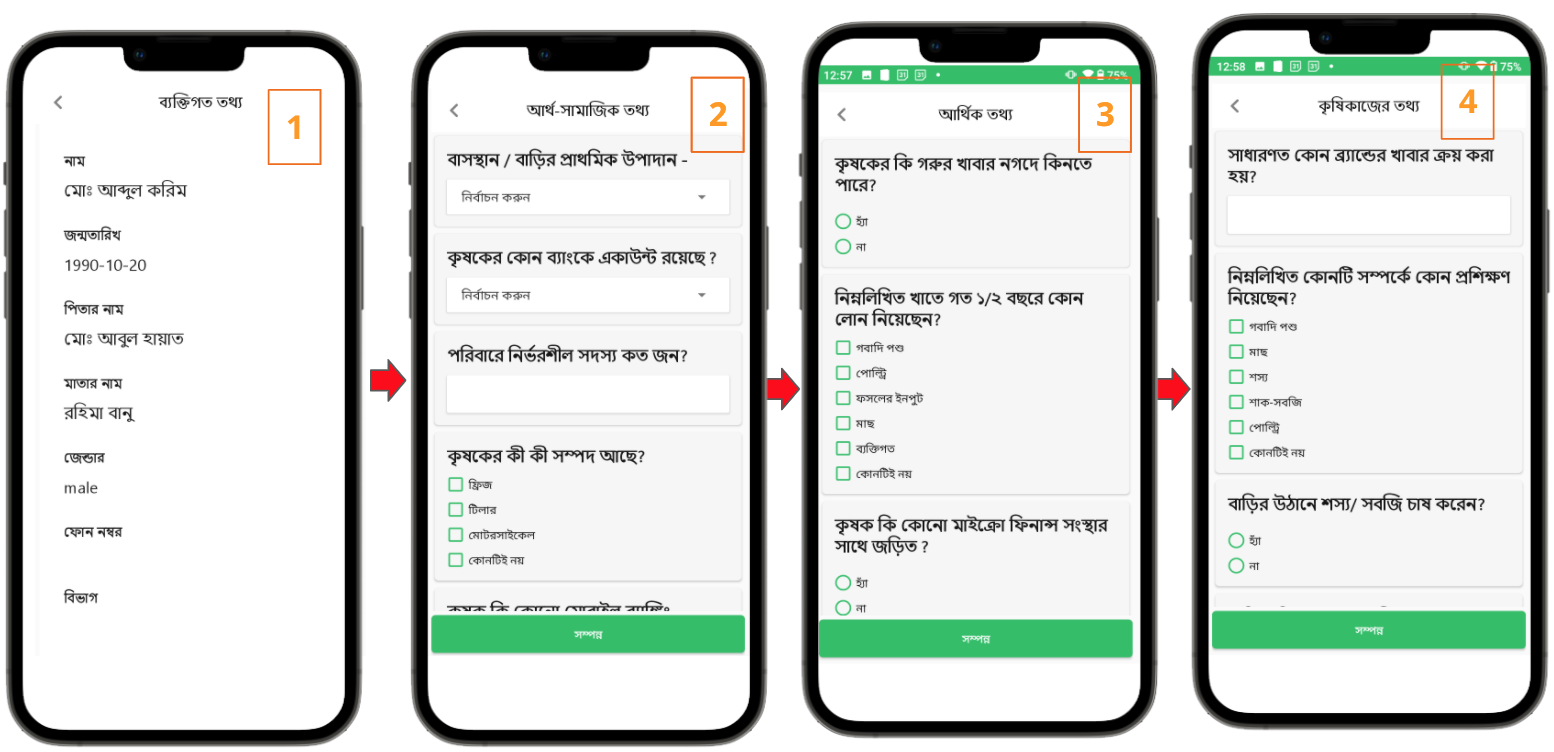

Sofol has been working as the bridge between farmers and iFarmer since September 2020. This is the app where farmers are onboarded and served by our field facilitators. Facilitators need NID cards of the farmers to onboard them in the app. We use Porichoy API to verify the farmers and onboard them into our system. And to apply for farm financing, facilitators fill up farmers’ KYC questionnaires for us to assess thin risks. We interviewed 25+ of our facilitators serving farmers in 17 districts and found that on average, a facilitator onboards 8-10 farmers and submits around 6-8 financial requests per day. For these procedures, facilitators must visit farmers at least once who live in rural areas where internet and network connectivity is a huge concern! Hence it is very inconvenient for our facilitators to onboard and fill up farmers’ KYC with an unstable internet connection.

Farmer onboarding by NID verification

Through ongoing interviews and communication, we discovered back in December 2020 that facilitators’ operational activities were disrupted due to inconsistent internet connection. Needless to say, it became essential to come up with offline technology supporting the app/features to help our users.

We understand Offline features have great importance in developing countries like ours, especially in rural areas, where easy availability of smart devices along with fast internet connection is not available. We took that as a priority but also figured out this problem is not something that can be solved on the go. It’s a critical problem that needs to be properly assessed before we develop and release it.

We spent time collecting and analyzing technical challenges associated with this problem, which we kept in our backlog. We did some R&D and technical feasibility analysis with our tech team on facilitators' smartphone capacity, how much the devices can store data locally vs how much internet dependencies will be there. And even if we can not store them locally, what other options do we have for making these contents available to them without internet access? From our analysis, we found a facilitator has around 1500 farmers' portfolios on average which makes it a difficult task to ensure storing all these farmers' information locally on their smartphones. As a result, we decided not to keep the farmer portfolio locally in the first phase. Therefore, every time facilitators make a funding request offline, they have to re-fill the farmer’s KYC.

KYC questionnaires

To summarize, the major points we explored for this particular problem -

-

Users' device configuration and capacity

-

The cap limit for locally stored data on their low-end devices

-

Proper data syncing mechanism

-

KYC storage decision

As a result, we did not develop this feature hastily without gathering sufficient data and conducting a thorough analysis. Even though we were aware that the facilitators required it, the Product team took the call to wait for these concerns to be properly addressed before proceeding. It was our strong gut feeling that rushing things would compromise user experience and have a negative impact.

After completing a technical feasibility analysis on those concerns, we formally initiated the feature analysis and PRD for the development of Farmer onboarding and financial requests offline from October 2021. To save time, we created a user journey and conducted a prototype test on 5 facilitators in Bogra via a field visit. We tried to validate if it is understandable to distinguish between farmers added online and offline and how to sync offline data later on. Since our users are less educated and the text contents need to be in Bangla, we were doubtful whether it would be understandable to them. To our surprise, we found that our surveyed facilitators were very much familiar with these terms. We proceeded based on their feedback, despite knowing that this level of testing was insufficient. Since we can always make more iterations and improvements, we decided to start development which finally got released in January 2022.

In the last 3 months, a total of 1962 Farmers were onboarded and 646 financial applications were submitted from Sofol both online and offline.

Our next action plan is to make more iterative improvements. For the next phase, we need to explore keeping farmers’ entire portfolio locally with less storage usage. For data syncing, we need to ensure that this long data doesn’t get affected by a longer syncing time or large data size.

০১৩০২৫৩৬০২৬

০১৭৮৪১৬৭৯৭৩